THIS WEBSITE IS NO LONGER BEING UPDATED

VISIT ExemptPropertyTax.com for the latest petition form

VISIT ExemptPropertyTax.com for the latest petition form

Exemption from Property Taxes...

PLEASE READ: THE LATEST with the property tax exemption for 60+

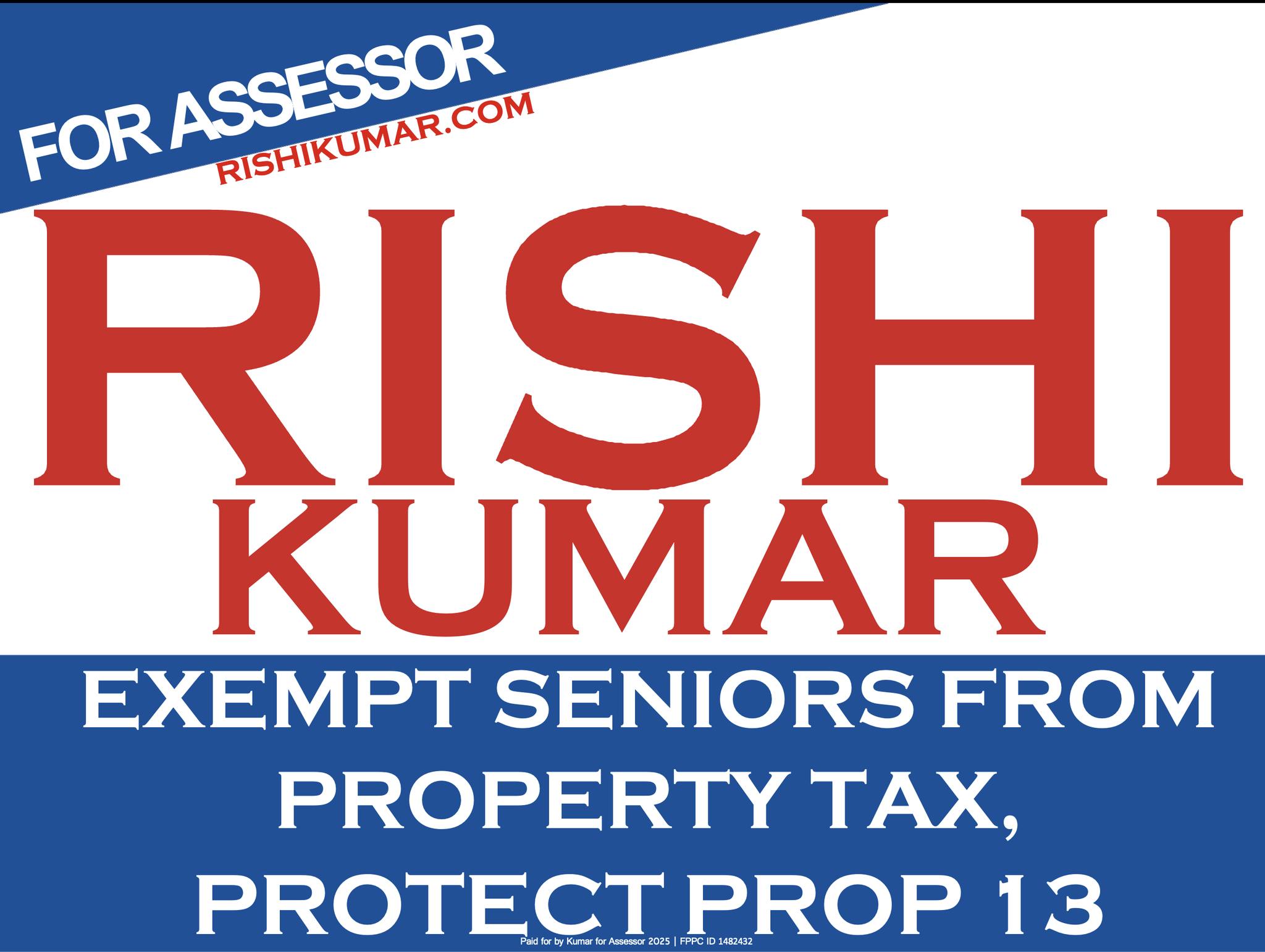

Great news! The ballot measure “The 60+ property tax Exemption Act of 2026” (#25-035) has been presented to California’s Attorney General for an official title. Rishi Kumar will get it done to provide property tax relief for all seniors.

A fully legal path: Every California resident age 60 and older automatically qualifies, with age as the only (major) requirement. This is a well-established and fully legal path used for major reforms in California, including Prop 13. Once the Attorney General approves the language, we will begin the signature-gathering phase. After collecting the required number of signatures (approximately 1,000,000) and receiving verification from the Secretary of State, the measure will be placed on the November 2026 ballot.

The truth is straightforward: An Assessor absolutely can initiate a statewide reform effort — just because no one in our county has tried it before doesn’t mean it cannot be done. Don’t let tax-grab politics or misinformation distort the facts. We are following the law, advancing reform, and delivering a path forward for California’s seniors.

How do we address the deficit from a senior property tax exemption?

There won’t be a deficit! Scroll down below.

No tax increases for anyone: My plan is to fund schools and essential services to the same level as today. See “Dispelling the Myth” below.

Sixteen States have Led Charge while CA has Lagged: Property tax reform is sweeping the nation — and Rishi Kumar is leading the charge here in California. Sixteen states have already begun the process and have delivered reform for seniors of their state. Washington and Colorado are prime examples (scroll down for details). Take Wyoming, for example: they are considering a bill that would set the taxable value of (statewide) residential property to 0% — effectively eliminating residential property assessments for seniors. Virginia followed this same exact approach to exempt veterans.

While other states are advancing reforms, California’s leaders are tiptoeing around the issue to keep property tax dollars pouring in — and in our county they’re even claiming this “isn’t possible.”

California cannot afford to be stuck in the past. It’s time for us to move forward and deliver real relief for homeowners. Prop 13 was a godsend (approved by voters—on June 6, 1978 passing with 64.8% support), insofar as it’s allowed seniors to stay in their houses.

Now Rishi Kumar is moving forward –– with this Prop 13 tried and tested approach –– to exempt Californians aged 60 and over from property tax payments. This will protect seniors from losing their home to rising taxes. Seniors who have spent their lives contributing to California’s communities will get to remain in their homes without the burden of property taxes. Scroll down to see the policy rational behind this.

Can Assessors move forward with such a ballot measure?

Of course! The claim that “Assessors can’t do this” is a falsehood being promoted by groups who benefit from property-tax overages, government overreach, and ever-increasing taxes. Their goal is to protect a system that channels more taxpayer dollars into expanding government bureaucracy. Scroll down to see how and why.

For seniors, ths is a path forward to defend your home, your retirement savings, and your peace of mind.

We are forging ahead

An amendment of Proposition 13 will grant them a full exemption on property taxes for their primary residence. Across America, many states* and counties have already implemented senior property tax relief — why not Santa Clara County?

We’d love your input— take the survey here.

Before you do that, please read my white paper “Modernizing Santa Clara County’s Property Tax System – A Blueprint for the Future” that can be found at the bottom of the home page.

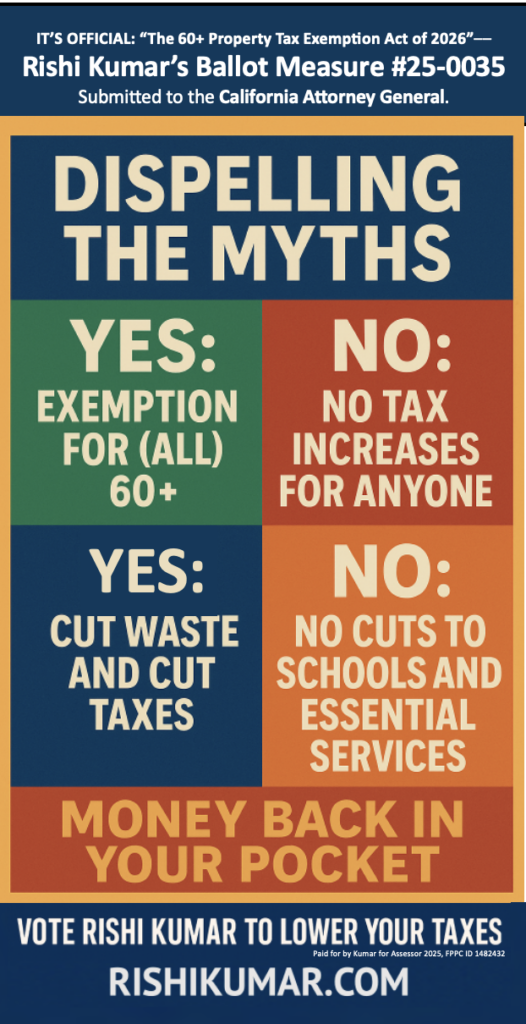

Dispelling the Myth...(there's no deficit, but actually a surplus)

Rishi is often asked this question:

“Rishi, if seniors are exempted from property taxes, will taxes go up for younger residents—or will funding for schools be cut?”

The answer is NO

Rishi’s plan maintains full funding for schools, the Sheriff’s Office, and essential services, while ensuring that no demographic or group sees an increase in taxes. Even after addressing the exemption, we would still come out with a huge surplus.

A senior property tax exemption is not just compassionate policy — it is powerful fiscal strategy. California has spent $24 billion on homelessness since 2019, yet homelessness still increased by 30,000 people, costing the state roughly $160,000 per homeless senior over five years with little measurable progress. Seniors now make up 48% of single homeless adults, and 41% experience homelessness for the first time after age 50, primarily due to lost income and rising housing costs. With senior homelessness increasing 84% in just four years, preventing even a fraction of these cases would generate massive savings.

By keeping older Californians housed through a modest property tax exemption, the state avoids exponentially higher medical, shelter, and social-service costs — effectively returning 10x the investment back into California’s coffers through prevention rather than crisis spending.

The senior property-tax exemption will also pump millions of new dollars directly into our local economy by putting money back into the hands of residents who spend every dollar here at home. Instead of disappearing into government bureaucracy, this money circulates through small businesses, restaurants, home-service companies, and community services — boosting jobs and strengthening our economic engine. It’s a commonsense, pro-growth reform that helps seniors and stimulates the entire county economy.

Press Release: Ballot Initiative has been submitted to California's Attorney General

KUMAR FOR ASSESSOR ANNOUNCES STATE BALLOT MEASURE

“60+ Property Tax Exemption Act of 2026” SUBMITTED TO THE CALIFORNIA ATTORNEY GENERAL

FOR IMMEDIATE RELEASE

Rishi Kumar, Kumar for Assessor 2025

Media Contact:

Dan Rhoads, Media and Press Liaison for Kumar for Assessor 2025

Phone 408 805 5993 || RishiKumar.com

Santa Clara County, CA — December 4, 2025 —

After months of legal drafting and review, Rishi Kumar’s “60+ Property Tax Exemption Act of 2026” has been formally received by the California Attorney General’s Office. The measure has been assigned Initiative No. 25-0035. The measure would apply only to primary residences and provide relief when at least one titleholder is aged 60 or older, with age being the only major factor.

“We can’t keep taxing seniors into the street. This is one giant leap forward for California seniors,” said Kumar. “It is a major tool in the fight against senior homelessness, and we are forging ahead to deliver the greatest property-tax relief in California since Prop 13.” Kumar, a candidate for Santa Clara County Assessor, authored the statewide ballot measure this fall with a team of attorneys. The Attorney General is now preparing the official ballot title and summary for placement on the November 2026 ballot.

To learn more about the proposal and how to support this effort, visit

RishiKumar.com/Seniors.

Opponent against the plan does not understand Property Tax Reform and do not understand the Ballot Initiative Process

Opponents have called it illegal and have spread false claims that assessors lack the authority to pursue reform. Kumar explained. “My opponent called it a form submission process at the WIllow Glen Candidate Forum. My opponent has never done this before and lacks understanding of how reform is done and how such an initiative can be passed. We are following the law, advancing reform, and delivering a future where seniors can live without fear of losing their homes. Our opponents are clueless about property tax reform and will do their utmost to RAISE taxes because that’s all they know.” Kumar said.

This Follows the Well Traveled (Legal Route) of Prop 13

“The process is legal (follows the proven path of Prop-13), proven, and already underway — and I will get it done. “It’s a perfectly legal approach! Just because no one in our county has done it before doesn’t mean it can’t be done,” Kumar said. “We won’t let tax-hungry politicians distort the truth anymore.”

The initiative is advancing under the same well traveled, legal, voter-driven framework used for some of California’s most significant legislative reforms, including Proposition 13. The initiative proposes a full property-tax exemption for every California homeowner aged 60 years and over, with age as the sole major qualification.

Yes, Assessors Can! Many Good Reasons for the Reform!

Despite an intentional misinformation campaign by opponents, the law is clear: An Assessor can initiate property tax reform efforts and assessors across the nation are engaging. 16 states have launched property tax reform efforts for seniors. Property-tax reform for seniors is sweeping America. Meanwhile, California — with some of the highest property taxes in the nation — has failed to act. “California cannot stay stuck in the past,” Kumar said.. “It’s time to deliver real relief to seniors who fear losing their homes to rising taxes.” A property tax exemption for residents aged 60 and above addresses several interconnected policy goals: stabilizing senior housing, supporting those on fixed income, reducing displacement risk, and recognizing decades of contribution to community systems. Aging in place is associated with improved health, emotional well-being, and community continuity. Understanding these dynamics provides insight into the broader value of supporting seniors in maintaining stable housing during later stages of life.

There will be no Deficit.

Prop-13 has helped California immensely and this will too!

“Seniors who built California’s communities deserve security, not fear,” Kumar said.. “We’re moving fast — and we will get this done. Critics have claimed the proposal would create a deficit — but the facts tell a different story. The senior property-tax exemption will pump millions of new dollars directly into our local economy by putting money back into the hands of residents who spend every dollar here at home. Instead of disappearing into government bureaucracy, this money circulates through small businesses, restaurants, home-service companies, and community services — boosting jobs and strengthening our economic engine. It’s a commonsense, pro-growth reform that helps seniors and stimulates the entire county economy.”

Prop 13 has helped California’s economy by providing homeowners and businesses with long-term tax stability, allowing families to stay in their homes and giving small businesses the certainty they need to grow and hire. Stable property taxes have encouraged investment, strengthened local communities, and prevented the kind of financial volatility that harms economic growth.

Tax will NOT Increase for Anyone

Rishi Kumar’s Property Tax Exemption for Seniors is designed to NOT reduce funding for schools, roads, and essential services. Instead of shifting the tax burden onto others (no one will see a tax increase), his plan focuses on reducing homelessness and cutting the endless cycle of spending on ineffective homeless programs.

At the Cupertino League of Women Voters Candidates Forum, Rishi declared that he would shave off $10 million from the $43 million Assessor’s office budget in the first 5 years as county Assessor and 50% in the next five year.

Tax Collection Gap Studies show that under-assessment errors and delays in property reappraisals cost counties millions annually. Kumar’s modernization plan ensures timely, accurate assessments for non-senior properties, preventing revenue leakage while protecting senior homeowners. His focus on data transparency and cross-department integration will help identify uncollected or misallocated tax revenues that currently go unnoticed.

The Ballot Initiative Team Invites Interns

The Senior Property Tax Exemption Ballot Initiative is looking for volunteers to help make history — a movement to put money back into the pockets of people and seniors who need it most. Join Rishi Kumar’s grassroots team to protect seniors, cut waste, and keep Californians in their homes. Sign up today and be part of real change — your voice and effort matter! https://tinyurl.com/CABallotInitiative

ABOUT RISHI:

Rishi Kumar is a Silicon Valley technology executive, public servant, and reform advocate committed to making government work smarter for the people. A mechanical engineer by training, he has led major modernization and operations initiatives in the tech sector and brings that results-driven mindset to public service.

Rishi previously served two terms on the Saratoga City Council, where he championed fiscal responsibility, modernization, and community safety—earning the highest vote count in the city’s 70-year history. He has also been a strong advocate for taxpayers, successfully pushing back against repeated rate hikes from San Jose Water Company and PG&E.

Today, as a candidate for Santa Clara County Assessor, Rishi Kumar is focused on cutting waste, improving efficiency, protecting Proposition 13, and advancing reforms such as a property-tax exemption for Californians aged 60 and over—ensuring seniors can remain in their homes with dignity and financial security. He has pledged to automate the property declines and send money back into the pockets of people as the county assessor. Rishi Kumar’s strength lies in blending technology and public service to deliver real results.

A Silicon Valley executive and mechanical engineer, he understands how to use innovation — not bureaucracy — to solve problems. As a CFO and software industry leader, Rishi has applied automation, AI, and data-driven efficiency to streamline operations, cut waste, and improve outcomes. He plans to bring that same approach to the Santa Clara County Assessor’s Office, replacing outdated systems with smart, automated solutions that deliver faster, more accurate assessments and return savings directly to taxpayers. His vision is clear: use technology to make government leaner, fairer, and focused on people — not politics.

Media Contact:

Media Contact: Dan Rhoads,

Media and Press Liaison for Kumar for Assessor 2025

Phone 408 805 5993 || RishiKumar.com || VoteRishiKumar<at>gmail.com

###

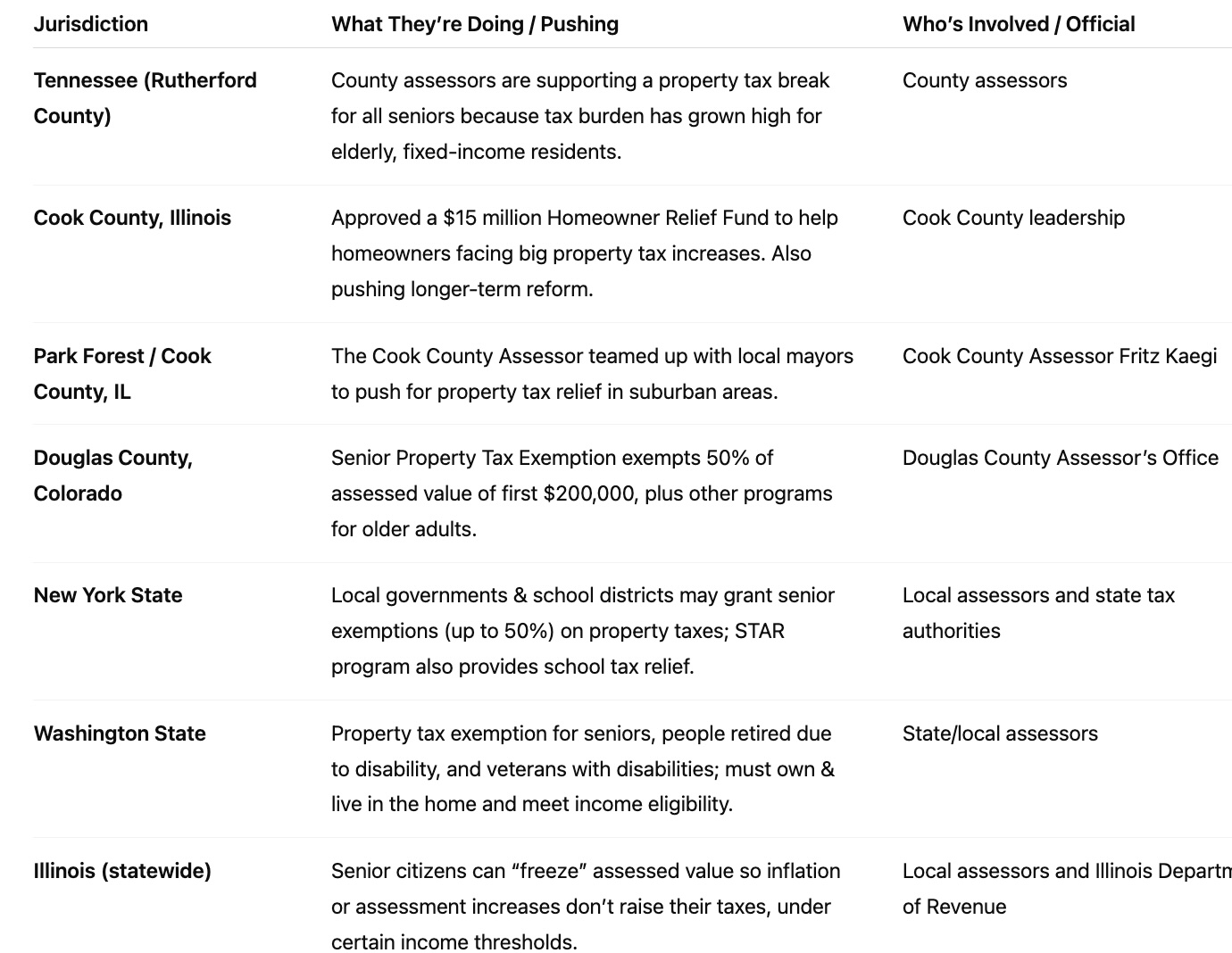

Assessors Across the U.S. Push for Property Tax Exemptions

Back in 2011, I launched Saratoga’s Got Talent to raise funds for the Saratoga Senior Center — and ever since, I’ve been a steadfast advocate for seniors. As a councilmember, I heard their concerns again and again: the rising cost of healthcare, utiliity bills, and the fear of losing their homes. As County Assessor, I’m committed to addressing these challenges head-on. Nothing ventured, nothing gained — and I will fight relentlessly for a property tax exemption for seniors until it becomes a reality.

Too many seniors—after a lifetime of work, raising families, and building our community—are now burdened by rising property taxes on fixed incomes. What should be the golden years of retirement can quickly turn into financial hardship. That’s why it’s critical we stand firm in protecting Prop 13 and honor the will of the voters who put it in place. But we can do more than just that…

That’s why I’m fighting for a full property tax exemption for all seniors—because seniors deserve to age with dignity in the homes they built their lives around. Seniors have contributed to our community and our economy for decades, and in their golden years, they should have the security of knowing their homes are truly theirs.

(10/15/2025) The Ballot Initiative Process: Property Tax Exemption for Age Groups 60+

We are launching a statewide ballot initiative to amend Proposition 13 and the California Constitution to waive property taxes for homeowners aged 60 and older. Here’s how the process:

The Office of Legislative Counsel is reviewing the precise legal language for the constitutional amendment to ensure it provides lasting property-tax relief for 60+.

Upon approval, it will submitted to the California Attorney General’s Office so that they can prepare the official title and summary that will appear on the petitions and ballot.

Once the Attorney General issues the title and summary, we will begin collecting signatures from registered California voters. Once enough valid signatures are confirmed, the measure will qualify for the next statewide general election ballot i.e November 3, 2026

A simple majority state-wide vote on November 3, 2026 will approve the amendment and make senior property-tax exemption a permanent part of California law.

(10/15/2025) Can Assessors Do This?

Yes, the County Assessor can absolutely plays a key role in shaping property-tax relief for seniors (60+), and there is clear precedent for this across the country.

Here are a few helpful points you can share with your neighbors:

1. The Assessor has authority and influence

While the Assessor cannot unilaterally change tax law, the Assessor does have the power to launch, sponsor, and champion statewide ballot initiatives that reform assessment rules and create exemptions.

California’s own Proposition 19 is an example — it was driven by county assessors and dramatically changed tax rules for seniors.

2. Senior exemptions already exist nationwide

Many states (Colorado, Illinois, New York, Tennessee, Texas and others) exempt or reduce property taxes for seniors, usually age 60–65+.

We are simply bringing California in line with what other states already do.

3. The Assessor’s role is central

The Assessor can:

Write the exemption policy and draft ballot language

Lead the certification process

Organize county-level fiscal modeling

Build the statewide coalition of counties

File and drive the initiative through the Attorney General

Mobilize voter support

This is exactly how Prop 19 was created — by assessors.

4. My plan is already in motion

I’ve been very public about pursuing a statewide ballot initiative to exempt homeowners 60+ from property taxes.

We already have:

Legal framework

Draft structure

Initial stakeholder support

Clear fiscal modeling targets

And a path to put this on the 2026 statewide ballot

5. Bottom line

Yes — the Assessor CAN drive this.

No one else has the combination of:

the data,

the technical authority,

the system access, and

the voter credibility

to make this happen.

And I’m the only candidate in this race with the experience, tech background, and statewide relationships to actually deliver it.

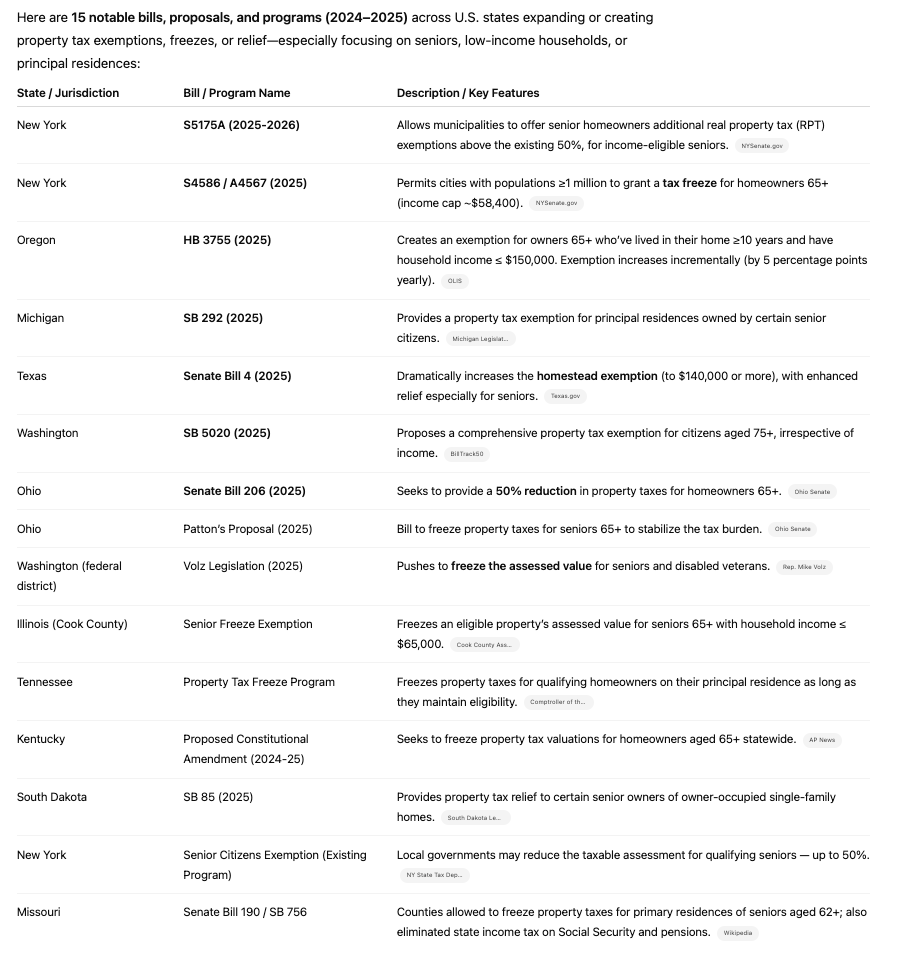

Already Done – Senior Property Tax Relief in Place

Already Done – Senior Property Tax Relief in Place

Colorado – Seniors 65+ can exempt 50% of the first $200,000 in value on their primary residence.

Illinois (Cook County) – Senior Freeze Exemption locks in assessed value for seniors 65+ with income ≤ $65,000.

New York State – Localities can reduce assessments up to 50% for seniors 65+, with income thresholds.

Tennessee – Senior Property Tax Freeze program locks in tax rates for eligible seniors on their primary residence.

Missouri – Counties may freeze property taxes for primary residences of seniors 62+; state eliminated income tax on Social Security/pensions.

Washington State – Exemptions for seniors, retired due to disability, and disabled veterans, based on income.

Florida – Strong homestead exemption and “Save Our Homes” cap (3% max annual increase); additional exemptions for low-income seniors 65+.

Texas – Expanded homestead exemption (up to $100K–$140K), with extra relief for seniors and disabled homeowners.

Proposed / Currently in Process

Proposed / Currently in Process

Michigan (SB 292) – Proposes a senior property tax exemption for principal residences

New York (Bills S5175A, S4586) – Expanding exemptions and allowing freezes for seniors in large cities with income caps.

Oregon (HB 3755) – Would grant exemptions to seniors 65+ with incomes ≤ $150K, phased in over time.

Ohio (SB 206, Patton’s Bill) – Seeks a 50% reduction or freeze in property taxes for seniors 65+.

Washington (SB 5020, Volz Bill) – Pushes to exempt or freeze assessments for seniors 75+ or disabled veterans.

Kentucky – Proposed constitutional amendment to freeze property valuations for seniors 65+.“

(8/15/2025) Here's Kumar's approach to exempt seniors

I’m pursuing the following approach:

#1 Advocacy at the State Level: I will work with legislators in Sacramento to draft a statewide “Senior Full Property Tax Exemption.” This would protect homeowners age 60+ who live in their primary residence to ensure the program targets those most in need.

#2 Immediate Relief Through Economic Distress Appeals: While we work toward permanent reform, I will explore options to expand and promote the existing economic hardship appeal process so seniors can get property tax reductions or deferments quickly, without legal red tape.

#3 Protection Until Sale: California State Controller’s program allows homeowners who are seniors, blind, or disabled to defer payment of property taxes on their principal residence if they meet certain criteria. We need a similar approach for seniors; property taxes would be waived until the home is sold. This ensures seniors can remain in their homes without financial strain.

#4 Constitutional Amendment: Amend Prop 13 to grant seniors a property tax exemption. Seniors are a huge voting bloc and the passing of such an amendment did happen in Virginia (2010) for veterans. Yes — Virginia successfully pushed a constitutional amendment that grants a property tax exemption to certain veterans. Can we do the same for seniors in California? Why not?

This is about more than tax policy—it’s about respect, fairness, and keeping promises to those who’ve given so much to our county. As your Assessor, I will use my position not just to manage assessments, but to lead this fight, rally public and political support, and make sure the exemption implementation process is seamless and accessible.

The bottom line is simple: seniors have earned the right to stay in their homes without the fear of losing them to rising taxes—and I will do everything I can to make it make it easier for them.

SCROLL DOWN TO READ THE WASHINGTON CASE STUDY

Note: California’s State Controller’s Property Tax Postponement Program already lets eligible homeowners—seniors, blind, or persons with disabilities—defer current-year property taxes on their principal residence, depending on their income and equity qualifications. This program has helped, but we can do a lot more!

Eliminate Deficit-Driving Waste

Rishi Kumar: A Track Record of Getting Things Done

Government has long funded waste with our taxes. It’s time to cut waste and return money to the ones who need it most.

This exemption proposal does not shift the burden of taxes onto others to make up for the property tax exemption. Instead, it calls for tackling inefficiency in government.

When others said it couldn’t be done, Rishi proved them wrong. He took on the San Jose Water Company, fighting unfair rate hikes and winning relief for thousands of families. As a councilmember of Saratoga, he didn’t have jurisdiction over the investor owned utility company, CPUC did. But he managed to force the hand of CPUC and reject, reduce or suspend 10 water rate increases.

As a Saratoga City Councilmember, he led bold initiatives that reduced burglaries by a historic 50%—a record achievement which got him reelected with the highest vote count in the city’s 70-year election history.

Rishi delivers results by applying the tech framework of getting things done. Discover his proven record of fighting—and winning—for the people.

Senior Property Tax Exemption in Washington State

Yes — Washington State offers property tax exemption programs for seniors and people with disabilities.

The exemption can reduce or eliminate certain levies for qualifying seniors.

The taxable value of their home is also “frozen” (i.e. the assessed value for taxing purposes won’t increase) so they’re shielded from rising market values.

There’s also a tax deferral option (not full exemption) for seniors with limited income — allowing them to defer paying taxes until later (e.g. when the house is sold).

Key Steps / Requirements to Qualify

To qualify for the Washington senior/disabled exemption or deferral programs, one generally must meet several criteria and complete a process:

Age / Disability Requirement

Be 61 years or older (or 57+ as surviving spouse) to qualify for the exemption.

For deferral, age 60+ or disabled.

Ownership & Occupancy

Own the home as of December 31 of the assessment year.

Use it as your principal residence.

Income / Disposable Income Limits

There is a cap on the income allowed (varies by year/county).

Application & Documentation

Submit an exemption application during a specified period.

Provide proof of age, income, ownership, occupancy.

Renewal / Review

The exemption is reviewed periodically; changes in income, ownership, or occupancy may require adjustment.

Repeal California's Prop 19 - "The Death Tax"

Here are three reasons why:

The Death Tax punishes families twice — after paying taxes their entire lives, Californians are taxed again when passing down their home or savings.

It forces heirs to sell family homes or small businesses just to cover the tax bill, tearing away generational security.

It drives wealth and jobs out of California, discouraging families and entrepreneurs from planting roots in our state.

Rishi Kumar's Long Standing Support for Seniors

As a Saratoga City Councilmember, I supported Saratoga’s designation as an “Age-Friendly City.”

I also launched the annual Saratoga’s Got Talent competition—bringing youth and seniors together while raising over $25,000 for the Saratoga Senior Center, funding that was very much needed.

When COVID-19 struck in March 2020, I made a decision that defined my approach to public service: I suspended my congressional campaign. “When we’re in crisis, we help,” I told my team.

I mobilized hundreds of grassroots volunteers to form the Neighborhood Pandemic Preparedness Team (NPPT), modeled after Neighborhood Watch. Our mission was simple—no one gets left behind. We reached 86,000 seniors, delivered groceries, picked up prescriptions, and even dropped off favorite coffees. Volunteers sewed 4,000 masks for the Valley Medical Foundation, launched a COVID-19 information hub, and organized 25+ virtual Reality Check with Rishi town halls featuring healthcare professionals, stimulus experts, and small business advisors.

Students who lost summer jobs joined us to lead online coding camps and entrepreneurship bootcamps, providing career guidance and tech education to hundreds of youth sheltering at home.

Through it all, I stayed focused on one thing—service. “This pandemic showed us what makes America special—neighbors helping neighbors,” I said then, and I still believe it today.

Residents noticed. One senior wrote, “Thank you for the coffee gift. It is the one constant my wife of 53 years loves in the morning in a world changing too rapidly.”

Another added, “It doesn’t matter what our political party is… thank you for all that you are doing to help others!”

My actions during the pandemic weren’t about politics—they were about people. In a moment of fear and uncertainty, I chose service over self-interest.

That same compassion for seniors, commitment to community, and problem-solving leadership is exactly what I’ll bring to the Assessor’s Office.

The Influence of the Assessor's Office

Property tax reductions under Proposition 8 should be automated by every Assessor’s Office when market values decline. During the 2008 housing crash, the Santa Clara County Assessor failed to apply these automatic reductions, leaving many homeowners overtaxed and forcing some into foreclosure. Proactive assessors in other counties have since shown that timely, automated reassessments can protect homeowners and prevent financial hardship.

Phong La (Alameda County): In 2023, proactively reduced property taxes for select homeowners whose property values had declined, earning positive media coverage for the initiative.

(Source: CBS News San Francisco — “Alameda County to reduce property taxes for select homeowners”)Jeff Prang (Los Angeles County): Publicly testified at the SCA 4 hearing to advocate for reforms to Proposition 19, following issues he observed in its implementation.

These examples show that other county assessors exercised discretion and initiative to protect homeowners and ensure fair assessments during times of economic stress. See table below – how Assessors across the country are pushing policy to protect seniors.

The Policy Rationale Behind a 60+ Property Tax Exemption

Executive Summary

A property tax exemption for homeowners aged 60 and over is designed to address the financial, social, and health-related challenges faced by older adults living on fixed or limited incomes. As housing costs continue to rise across California, many seniors experience growing difficulty maintaining stable housing. This paper outlines the underlying policy rationale for a senior property tax exemption, including its goals, expected benefits, and the broader implications for households, communities, and public systems.

The central principle behind such a policy is straightforward: enabling older adults to age in place supports family stability, community cohesion, and improved health outcomes while helping prevent involuntary displacement. Seniors have contributed to local tax bases for decades and rely on predictable housing costs in retirement. A structured exemption recognizes these contributions while supporting long-term social and economic stability.

Introduction

Property-tax exemptions for adults aged 60 and above are grounded in the need to provide financial relief to older residents who face rising costs but often have stagnant income. Many seniors rely on retirement sources such as pensions, Social Security, or modest savings that do not increase at the same pace as property taxes. As valuations and tax obligations grow, seniors may experience financial strain, prompting discussions about policy mechanisms to promote stability and prevent displacement.

Objectives of a 60+ Property Tax Exemption

Helping Seniors Remain in Their Homes

A key objective is enabling older adults to continue living in their homes. Stability in housing supports independence and security, particularly for individuals who may have lived in the same residence for decades. An exemption reduces financial pressure and mitigates the risk that rising property taxes force seniors to relocate.

Protection for Fixed-Income Households

Property taxes often increase faster than cost-of-living adjustments. For seniors whose income does not rise proportionately, tax burdens can become unsustainable. Exemptions allow limited income to be allocated toward essential needs such as healthcare, food, medication, and utilities.

Preventing Displacement

Rapid economic growth and rising property valuations can unintentionally displace long-term residents. A senior exemption acts as a buffer against the economic forces that could otherwise push older adults out of their communities and away from familiar support structures.

Supporting Community Continuity

Long-time residents strengthen neighborhood cohesion. Their ongoing presence contributes to local engagement, volunteerism, community memory, and intergenerational stability. Reducing involuntary mobility helps preserve these benefits.

Acknowledging Long-Term Contributions

Many seniors have contributed to local education systems, infrastructure investments, and public services through decades of property-tax payments. Offering relief in later years recognizes this long-standing support.

Why Aging in Place Matters

Stability and Familiarity

A long-term home provides predictable routines and familiar surroundings that support cognitive and emotional well-being. For older adults, especially those managing early memory decline, maintaining a known environment can reduce stress and confusion.

Emotional and Psychological Health

Remaining in one’s home reinforces personal identity and dignity. Research shows lower rates of depression and improved emotional health among seniors who maintain their residential stability.

Social and Community Networks

Older residents often depend on local relationships built over many years—neighbors, small businesses, community groups, and places of worship. These networks form an informal safety net that can support daily needs and reduce isolation.

Health and Safety Considerations

Relocation is physically and emotionally challenging for many older adults. Adjusting to new layouts and unfamiliar environments may increase the risk of falls, disrupt medication routines, and elevate stress levels. Studies indicate higher hospitalization rates soon after senior relocation.

Financial Predictability

For many seniors, a paid-off home offers stable monthly costs. Moving often involves higher rent or mortgage costs, new utility deposits, and other up-front expenses that can erode retirement savings.

Improved Long-Term Health Outcomes

Research indicates that seniors who age in place often maintain greater independence, experience better health outcomes, and may delay or reduce the need for institutional care. These outcomes also benefit families and community support systems.

Consequences of Senior Displacement

Psychological Impacts

Losing a long-term home can be associated with anxiety, grief, and emotional distress. Involuntary relocation disrupts stability and may impact mental health significantly.

Loss of Support Systems

Displacement can sever ties with neighbors, nearby family, and healthcare providers. Loss of these support structures may increase social isolation, which is linked to negative health outcomes and higher mortality risk.

Physical Health Risks

Relocation stress is correlated with increased hospitalization rates among seniors. Navigating a new environment may also increase vulnerability to accidents or disorientation.

Financial Strain

Relocating often introduces higher costs, potentially depleting retirement income. Increased housing expenses can create long-term financial instability.

Broader Community Effects

Communities benefit from retaining long-time residents. When seniors are displaced, neighborhoods lose historical knowledge, volunteer contributions, and intergenerational relationships that contribute to social resilience.

Conclusion

Compelling Data – why we need this policy in California Seniors and Homelessness in California

Homelessness still remains a top concern in the Bay Area. In a recent poll, 75% of those responding said they were “very concerned” or “somewhat concerned.”

Older adults — defined as 50+ or 55+ — are among the fastest growing groups entering homelessness in California.

https://justiceinaging.org/california-older-renters-unaffordability-homelessness/

A recent statewide study found that among single homeless adults in CA, 48% are age 50 or older.

https://bcsh.ca.gov/calich/meetings/materials/20230907_study_homelessness.pdf

Among homeless older adults, 41% reported their first experience of homelessness after age 50.

https://bcsh.ca.gov/calich/meetings/materials/20230907_study_homelessness.pdf

In a span from 2017 to 2021, the number of older adults accessing homelessness services increased by ~84%, despite the overall senior population growing only about 7%.

https://calmatters.org/health/2023/02/california-homeless-seniors/

These statistics show a clear upward trend in senior homelessness, and that a significant share of homelessness in California now involves older adults.

An Electric Panel Upgrade will be VERY Expensive ––Stop the Natural Gas Ban by signing this petition

Recent decisions could cost Seniors $50,000 to $100,000 or more after their retirement

Retired homeowners across Santa Clara County are facing new financial burdens that threaten their stability. Agencies such as the Bay Area Air Quality Management District (BAAQMD) are pushing electrification mandates that require households to replace gas appliances and upgrade electrical systems. For many older homes, this means costly rewiring and electrical panel replacements that can range from $50,000 to $100,000—a price tag most seniors living on fixed incomes simply cannot afford.

At the same time, the 2025 sales tax increase (Measure A) and the transportation tax of 2026 (Measure B) and similar proposals continue to raise tax obligations, creating an ever-growing financial strain on seniors who should be enjoying security in retirement, not worrying about being taxed out of their homes.

This is why the upcoming election for County Assessor matters so much. Rishi Kumar has a proven record of fighting for residents against powerful institutions. He has challenged PG&E repeatedly to demand accountability after years of rising utility bills and safety failures. He stood up for neighborhoods impacted by PG&E’s negligence and pushed for consumer protections.

Rishi Kumar also challenged the San Jose Water Company over repeated water rate hikes, organizing residents, demanding transparency, and successfully halting unjustified increases. His leadership saved ratepayers millions and proved he would not back down against entrenched bureaucracies.

Today, Kumar is focused on seniors—those most at risk of being priced out of their homes. He has committed to property tax exemptions for ALL SENIORS, recognizing that while mandates and taxes rise, retirement incomes do not.

By electing Rishi Kumar as County Assessor, retirees will have a watchdog who will continue fighting on their behalf—just as he fought PG&E and the Water District. For seniors, the choice is clear: a vote for Rishi Kumar is a vote to defend your home, your retirement savings, and your peace of mind.

Property Tax Reform is Sweeping the Country

Yes, Assessors have the Authority!