"THE 60+ PROPERTY TAX EXEMPTION ACT OF 2026" 25-0035

“Let’s fight to make California Affordable“

The Election's Over

But our fight for affordability continues

(12/30/2025)

The push for California's property tax exemption continues!

The people of Santa Clara County have spoken, and I respect the outcome of December 30, 2025.

I am deeply grateful for the trust and support shown by residents across the county, and especially to the volunteers who believed in our campaign. Together, we gave it our all.

I’m sincerely thankful to each of you who stood with me. I believe deeply that choosing the harder, principled path matters more than taking the easy one—and that conviction guided us every step of the way.

I hope we moved the conversation forward in meaningful ways. Perhaps the moment wasn’t quite right—but we hold our heads high. We were driven by integrity, purpose, and a belief in something larger than ourselves. That does not end here.

My commitment remains unwavering: to be a fearless voice for truth, accountability, and good governance.

The work to advance the 60+ Property Tax Exemption ballot measure will continue. The affordability crisis facing seniors and families in Santa Clara County—and across California—is urgent, and I will pursue this effort with determination.

Contact me if you would like to get involved.

Thank you again for your trust, your support, and your belief.

With gratitude,

Rishi Kumar

BIG ANNOUNCEMENT!!

Here's the Announcement on Major Progress with the 60+ Property Tax Exemption

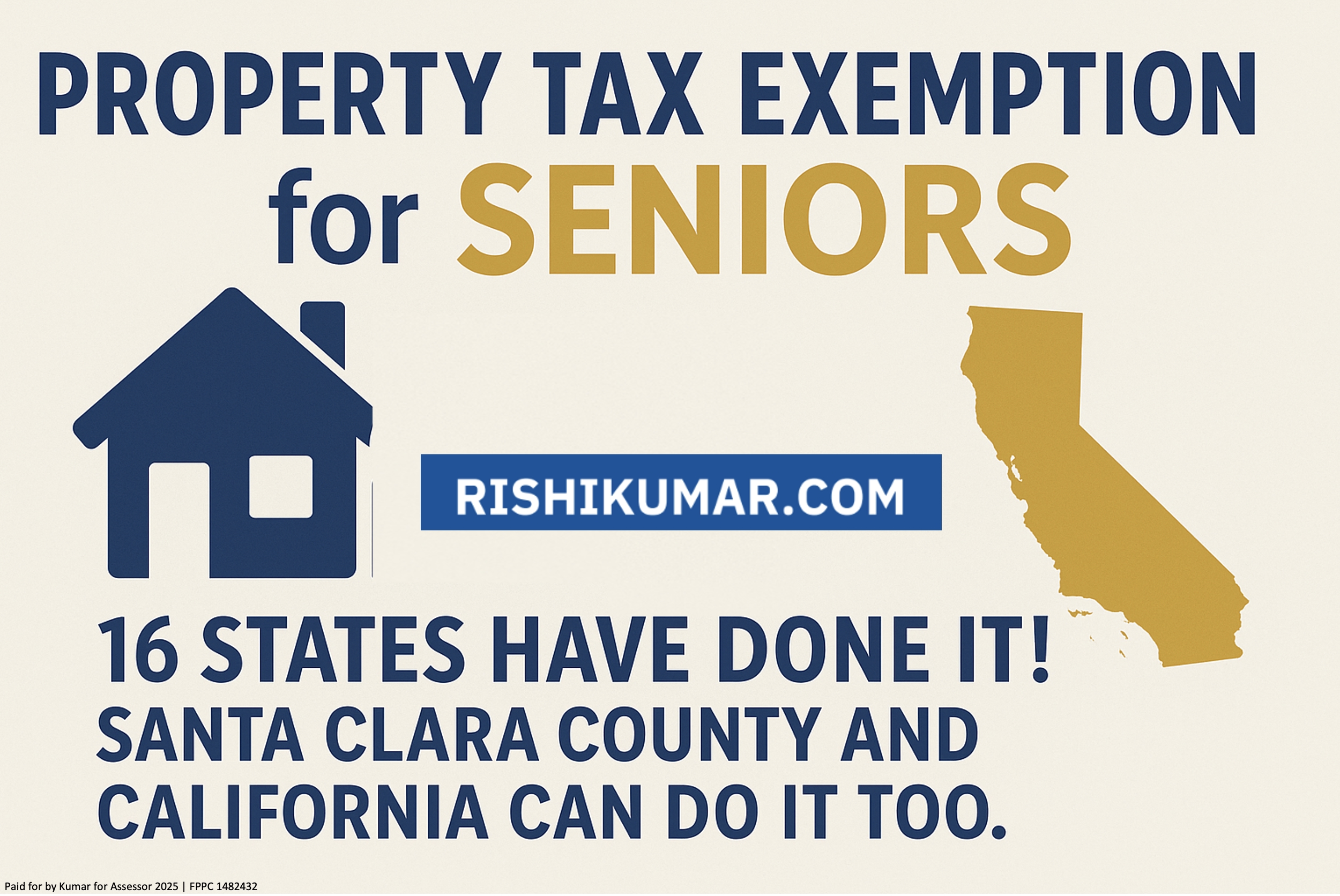

Rishi Kumar is thrilled to announce the property tax exemption update: We have officially submitted “The 60+ property tax Exemption Act of 2026” #25-0035 ballot measure to the California Attorney General — a critical step has been completed. Our goal is to place the measure on the ballot for a November 2026 California vote. Once passed, every California resident age 60 and older automatically qualifies for a property tax exemption, with age as the only (major) requirement.

As the proponent, I held our initial meeting with the California Attorney General’s team on 12/8, and the initiative is progressing smoothly. This work began earlier this fall, and I am delighted to have completed a key first step. Once the Attorney General approves the language, we will begin the signature-gathering phase. After collecting the required number of signatures (approximately 1,000,000) and receiving verificiation from the Secretary of State, the measure will be placed on the November 2026 ballot.

A fully legal path: This is a well established and fully legal path used for major reforms in California, including Prop 13 (1978). We are following the law, advancing reform, and delivering a path forward for California’s seniors.

Sixteen states have done it: We are moving forward to provide tax relief to seniors, while protecting funding for schools, law enforcement, and essential services. Sixteen states are already advancing similar reforms, and assessors nationwide are leading property-tax reform efforts. New York’s Governor Hochul has launched an exemption for seniors. Virginia even exempted veterans using this exact ballot initiative process.

Seniors deserve peace of mind during their golden years. A property tax exemption plan for seniors is sweeping the country. It’s time we did it here in California!

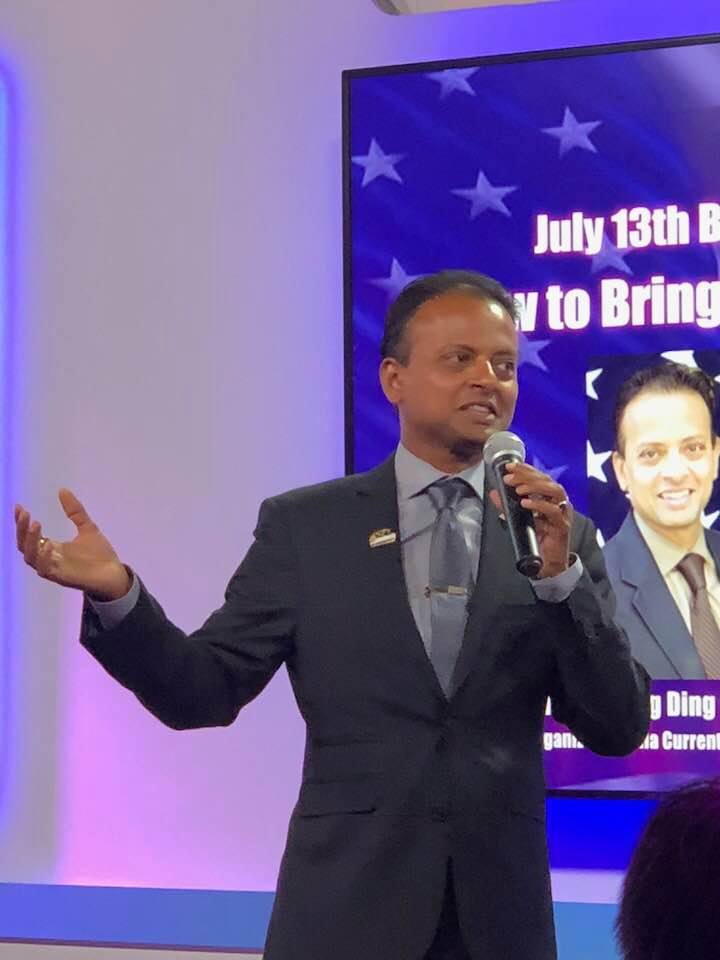

Assemblymember Kansen Chu (Emeritus) supports the 60+ Property Tax Exemption Policy

Mayor Jose Esteves of Milpitas (Emeritus) supports the 60+ Property Tax Exemption Policy

Top 5 Reasons to Vote for Rishi Kumar

Rishi Kumar's Agenda as County Assessor

Home Prices have fallen in 2025.

Do you see a property tax reduction?

Do you see a property tax reduction?

Here is Rishi Kumar’s plan to automate Prop 8 mandated property tax reductions when home values fall and put your money back into your pocket

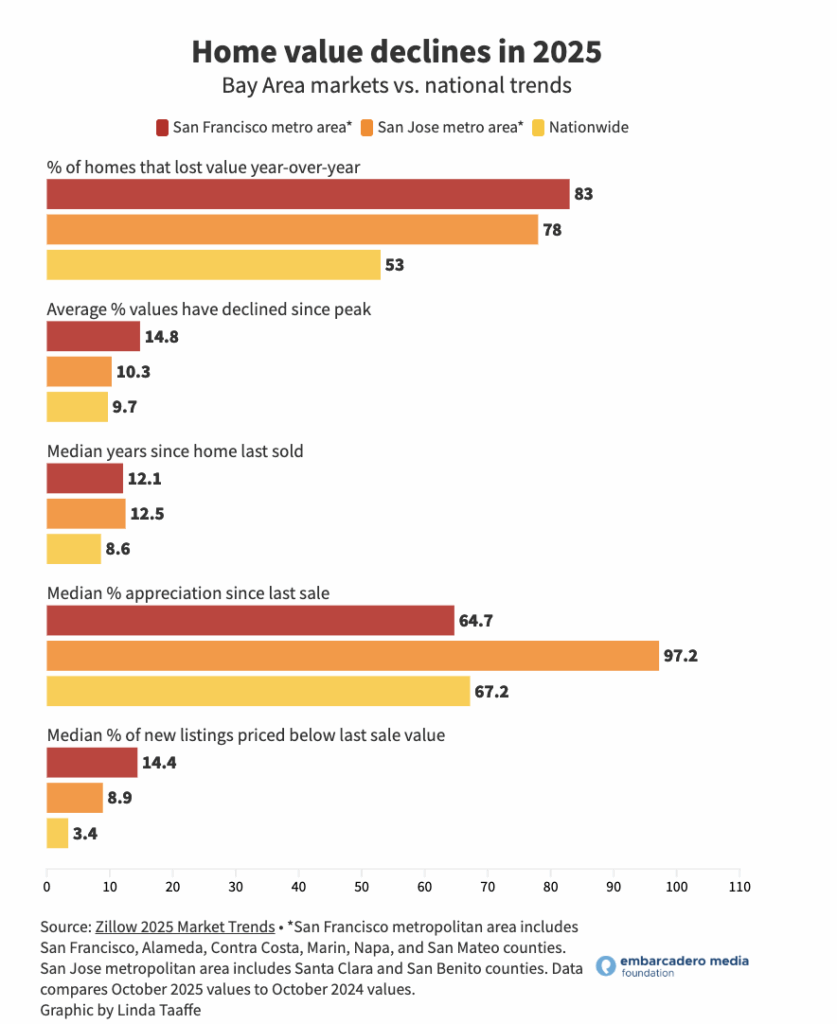

New Zillow data (November 2025) confirms what homeowners are feeling:

Home values are dropping across America — and the Bay Area is among the hardest hit

San Jose Metro (including Santa Clara County): 78% have declined

Under Proposition 8, when your home value drops, your property taxes should drop too. But Santa Clara County doesn’t adjust assessments automatically. Homeowners are forced to:

- File appeal

- Chase the Assessor’s Office (and the appeals process has been clear as mud)

- Gather their own comp, and

- Wait months for answers

Meanwhile, thousands are being overcharged every year.

I’m going to fix that. My Plan for Automatic Property Tax Reductions

As a Silicon Valley tech executive with deep experience in AI, data systems, and modernization, I will:

1. Automate Prop 8 Reductions: Every homeowner gets an automatic annual value reduction in a downturn — no forms, no appeals.

2. AI-driven Market Monitoring: My system will instantly detect declining neighborhoods using real-time market data.

3. Instant notifications: You’ll receive your updated assessment automatically — transparent, accurate, and data-backed.

4. End the burden on Homeowners: The responsibility shifts to the Assessor’s Office.

You shouldn’t have to chase the government for fairness.

5. Fair restoration when property prices rise: When values recover, assessments adjust gradually — no shock increases.

This will be the most automated, homeowner-friendly property tax system in California. Even the appeal process will be automated as far as possible – and the process will no longer be as clear as mud.

Why I Am Best Suited to Deliver This

This reform is not theoretical — it requires a rare combination of skills that aligns directly with my background:

1. I am a Silicon Valley AI & Modernization Leader

For decades, I’ve led modernization projects at scale, replacing outdated systems with automated, intelligent platforms. This is exactly what the Assessor’s Office needs:

• automation

• data integration

• real-time modeling

• operational redesign

My opponent has no background in technology or modernization.

2. I Have a Demonstrated Record of Fixing Large, Broken Systems

I’ve worked on AI-driven solutions in government, transportation, utilities, and large enterprises, even authored a book on AI. I know how to transform a bureaucratic, paper-based system into an accurate, efficient, digital one.

3. I Have a Public Record of Fighting for Residents

I led the “No on Measure A” campaign against a sales tax increase, quoted in almost 50 TV and news pieces speaking against waste and county bloat. I’ve fought PG&E, San Jose Water Company, and bureaucratic waste — consistently protecting taxpayers. This is the mindset needed to fix assessment failures and deliver automatic reductions.

4. I Know How to Build Large Coalitions and Deliver Outcomes

From neighborhood safety programs to fighting San Jose Water Company, to countywide reform campaigns, I’ve always succeeded by mobilizing communities and driving change. Transforming the assessor’s system requires exactly that — leadership plus execution.

5. I Understand the Pain Homeowners Are Feeling

As someone who has talked to thousands of homeowners in Santa Clara County, I know the struggles of overassessment, bureaucratic delays, and rising taxes. That’s why this is personal — and why I’m committed to delivering a fair system.

Bottom Line: When 78% of homes in our county lose value, your taxes should reflect that – immediately, automatically and accurately.

I will deliver:

• automated reductions

• transparent assessments

• modern systems

• and homeowner-first service

This isn’t just a plan — it’s a promise backed by my expertise, my record, and my leadership

PROACTIVE LEADERSHIP

"In 1978, California voters approved Proposition 8, giving counties the authority to temporarily reduce property tax assessments when real estate values decline. As your County Assessor, I will ensure these reductions are applied automatically whenever property values decline—so you get a property tax credit without having to fight through bureaucratic "clear as mud" appeal process and red tape.

I’ll make sure you automatically get the property tax reduction you deserve — no appeal needed. This reform is decades overdue, and I will fix it once and for all."

- Rishi Kumar

Modernizing Santa Clara County's Property Tax System - A Blue Print for the Future

Santa Clara County’s Property-Tax Assessment: Today and the Future

Author: Rishi Kumar, Candidate for Santa Clara County Assessor

Executive Summary

Property-tax assessment has undergone a profound transformation over the past several decades. Once a slow, manual, and highly subjective process, it has evolved—at least in leading jurisdictions—into a modern, data-driven discipline. This evolution is driven by digital integration, algorithmic modeling, and the rise of artificial intelligence.

Modernization has made the system fairer, more accurate, and far more transparent. Nearly every taxpayer benefits when valuations reflect true market conditions and administrative efficiency replaces paper-based backlogs. Despite being globally recognized as an innovation hub, Santa Clara County has not applied its technological strengths to property-tax administration. This white paper explores how assessment practices have evolved, how AI is revolutionizing the field, and what steps are necessary to bring Santa Clara County’s valuation systems to the forefront of fairness and transparency.

The Old Era of Property-Tax Assessment

The Assessor’s Office has $120 billion tied up in appeals—delayed by outdated technology, poor morale, and failed leadership. Legacy COBOL systems still run core functions and upgrade hasn’t happened for decades. A consulting report commissioned by the Board of Supervisors in 2004 concluded that, with competent oversight, the office’s computer system could be replaced within seven to ten years. Two decades later, modernization still lags. The Assessor’s office has struggled. Such as Larry Stone referred to Apple’s spaceship campus in Cupertino as “the most unique property probably in the United States,” and not something that can easily be assessed with standard metrics. When Stone announced his retirement, one reason he cited was that the county had just approved a contract to replace the “more-than-40-year-old software system. Yes, Santa Clara County Assessor’s office kept relying on a decades-old computer system.

Even today, the appeals process is as clear as mud. One appraiser has one set of requirements, another has a completely different set, and homeowners are left running in circles with no consistency or accountability. It’s a broken system — confusing, arbitrary, and deeply frustrating for taxpayers who are simply trying to correct unfair assessments.

Steve Sun from the San Tomas Aquino Park neighborhood has explained his experience on Nextdoor. He showcases exactly what thousands of residents have quietly endured for years. When he remodeled his home, his property taxes more than doubled, and the appraiser handling his case not only withheld information but even harassed him. Despite being a licensed civil and structural engineer with extensive documentation, he was dragged through multiple appeal hearings that were, in his words, “a joke,” because the county’s process lacks standards, transparency, and fairness.

Even worse, Steve discovered major irregularities across the county: homes with similar characteristics receiving wildly different valuations — sometimes four times apart — with no justification.

This is what happens when an outdated, mismanaged system operates without oversight or modernization. This is what happens when insiders protect the status quo instead of fixing it. And this is why residents are losing trust in the Assessor’s Office.

A system this inconsistent, this opaque, and this unaccountable isn’t just inefficient — it’s harmful. Seniors, families, and vulnerable homeowners bear the financial burden. Taxpayers waste months navigating contradictory instructions, arbitrary decisions, and a bureaucracy that seems determined to wear them down.

We need concrete reforms to restore fairness, transparency, and integrity to the assessment and appeals process.

When Oversight Fails: Why Santa Clara County’s Assessment System Needs a Hard Look

Property owners expect fair and consistent valuations from their county assessor—especially when the market shifts. Yet Santa Clara County’s 2019–2020 Assessor’s Report (page 21) recorded only nine Proposition 8 temporary value declines as of January 1, 2019. That number defies market reality: in 2018 alone, Palo Alto saw 368 home sales, and the Assessment Appeals Board acknowledged a 14 percent decline in values from 2018 to 2019. If the office truly reflected market conditions, why were fewer than 3 percent of those homes reduced?

When questioned about the discrepancy, Assessor Larry Stone reportedly replied, “I don’t know,” before ending the call. While the office once issued voluntary reductions during the 2008–09 financial crisis, it has been far less proactive in recent cycles. State law requires reassessment in the year after a Prop 8 reduction; the burden should not fall on taxpayers to file yearly appeals. Larry Stone refused to tax the Giants, choosing to give them a tax break.

For most of the 20th century, assessors operated in a paper world. Property values were estimated through site visits, handwritten notes, and appraisers’ personal judgment. Historical records were often fragmented, stored across filing cabinets, or even misplaced during administrative transitions.

This process was inherently limited. Appraisers might review only a handful of comparable sales, often missing emerging micro-market trends. Two nearly identical homes could be assessed at noticeably different values simply because each was handled by a different appraiser or reviewed at a different time.

Equity suffered as a result. Many properties were reassessed only after a sale or renovation, meaning neighbors could pay drastically different taxes for similar homes. Appeals were frequent, often requiring taxpayers to navigate lengthy and opaque processes. The lack of standardization, quality control, and transparency eroded trust between residents and local government.

The Shift to Modern CAMA Systems

The introduction of Computer-Assisted Mass Appraisal (CAMA) systems in the late 20th century marked a turning point. These systems standardized methodology and introduced statistical rigor. Rather than valuing properties one at a time, assessors could analyze thousands of parcels simultaneously using models that consider sales data, structural characteristics, and neighborhood trends.

Modern CAMA platforms integrate multiple data sources: GIS mapping, permit databases, construction records, zoning data, and real-estate transactions. This integration allows assessors to generate valuations that are timely, defensible, and comparable across similar classes of property.

CAMA also transformed taxpayer engagement. Homeowners can now log into online portals to view assessment details, see comparable property data, and understand how their valuations were derived. Transparency not only reduces appeals but also fosters trust by demystifying the process.

The AI Revolution in Property-Tax Assessment

Artificial intelligence represents the next frontier in fair and efficient valuation. Traditional CAMA systems, though powerful, are built on static models that require manual adjustment. AI, by contrast, continuously learns from new data and refines its predictions.

Machine-learning models can process decades of historical sales data to identify subtle pricing correlations—factors like proximity to parks, changes in commute times, or evolving neighborhood amenities. They detect valuation anomalies in real time, flagging parcels that may deviate from fair market patterns before tax bills are issued.

AI tools can also automate labor-intensive administrative work. Permits, blueprints, and even handwritten or scanned forms can be digitized and analyzed through natural language processing. Property photos can be classified and compared automatically to verify updates or condition changes. These automations reduce human error and allow skilled appraisers to focus on complex or contested cases that require professional judgment.

AI-driven property tax assessment generally refers to the use of advanced analytics and machine learning models to estimate property values more accurately and efficiently than traditional manual methods. These systems ingest large volumes of data—such as property characteristics, historical sales, market trends, and geospatial information—and apply algorithms like regression analysis and predictive modeling to generate fair market valuations.

This approach emphasizes automation, scalability, and consistency, enabling assessors to perform mass appraisals quickly while maintaining compliance with industry standards. Additionally, AI solutions often include features, allowing assessors to review comparable sales, adjustment logic, and evidence statements to ensure transparency and defendability in audits or appeals. This combination of data integration, predictive modeling, and human oversight helps jurisdictions improve accuracy, reduce bias, and streamline the overall assessment process.

By enhancing precision, AI directly benefits taxpayers. Fewer overassessments mean fewer appeals and faster resolutions. For long-time homeowners, seniors, and those on fixed incomes, accurate assessments can make the difference between stability and financial strain. Across the country, AI-enabled assessors’ offices are already reporting shorter turnaround times, higher satisfaction scores, and measurable improvements in equity.

The Risks of Falling Behind

Santa Clara County, despite being the global epicenter of innovation, still relies on outdated workflows and disconnected legacy systems. Manual entry, batch updates, and siloed databases make it difficult to achieve consistency. These inefficiencies ripple outward—slowing down valuations, delaying updates, and increasing the likelihood of errors.

Failing to modernize has real consequences. When taxpayers feel overassessed or unfairly treated, they lose confidence in local institutions. Appeals surge, staff workloads grow, and administrative costs balloon. Over time, these inefficiencies compound into fiscal strain for the county and frustration for homeowners.

Delays in adopting new technologies are not simply technical oversights—they are equity issues. Taxpayers deserve fair and timely assessments supported by modern systems that reflect the technological sophistication of our region.

A Vision for a Modern, AI-Enabled Assessor’s Office

The path forward requires leadership fluent in technology, data governance, and public accountability. A modernized Assessor’s Office should implement:

• Integrated, AI-driven CAMA systems capable of adaptive valuation and real-time quality control.

• Robust data connections between departments, ensuring permit approvals, zoning updates, and construction changes are instantly reflected in the tax roll.

• User-friendly online platforms that show taxpayers exactly how their values were calculated and provide tools to contest potential errors transparently.

• Ethical AI frameworks that ensure models are explainable, unbiased, and subject to continuous review by human experts.

In this vision, AI supports—not replaces—the expertise of professional appraisers. Technology handles repetitive, data-heavy tasks, while humans focus on judgment, communication, and community engagement. Together, this partnership would restore trust, create operational excellence, and enhance fairness across Santa Clara County.

CALL TO ACTION

From paper-based ledgers to intelligent automation, the story of property-tax assessment is one of modernization driving fairness. Artificial intelligence now represents the logical and necessary next step in that evolution.

Counties that embrace AI deliver more accurate valuations, fewer appeals, and greater confidence in government stewardship. For Santa Clara County, modernization is not an experiment—it is an obligation to residents who expect the same level of innovation from their public institutions that they see in their private lives.

Leadership will determine whether this transformation succeeds. A forward-looking Assessor’s Office—guided by experience, transparency, and technical expertise—can make Santa Clara County a national model for fair, efficient, and equitable tax administration.

An assessor’s duty is to ensure accuracy, fairness, and transparency, not to protect institutional comfort. Santa Clara County residents—and the employees who serve them—deserve leadership willing to welcome oversight and adapt to data rather than hide behind it.

If fewer than ten property owners received reductions in a year when values clearly fell, the system is failing both taxpayers and public servants.

The time has come for an independent review—by the Civil Grand Jury, the Board of Supervisors, or the voters themselves—to restore confidence in how Santa Clara County assesses, and serves, its people.

Rishi Kumar has been elected to the following..

Two consecutive terms on the Saratoga City Council

Executive Board (multiple terms) to the California Democratic Party

Delegate (multiple terms) to the California Democratic Party

Board member (multiple terms) of the California Democratic Party API Caucus

Bernie DNC Delegate 2016

Biden DNC Delegate 2024

Central Committee Delegate, Santa Clara County Democratic Party

Appointed to the following..

Governor’s University of California Regents committee

California Department of Education’s K-12 public school computer science curriculum implementation panel – the curriculum is now live for every public school child

Bay Area Indian American Democratic Club, President

NLC Asian Pacific American Municipal Officials APAMO Board member

Director – CA League of Cities API Caucus

Member National League of Cities, Energy and Environmental Resources Committee

League of CA Cities Employee Relations Policy Committee

League of CA Cities Administrative Policy Committee

Commissions and Boards

Santa Clara Valley Water Commission

Santa Clara County Library District Board of Directors

West Valley Clean Water Program Authority Board of Directors

West Valley Solid Waste Management Authority Board of Directors

Saratoga Ministerial Association

Saratoga Chamber of Commerce