Are we going to watch America's sputnik moment playing out or do something?

America’s future with crypto is currently on shaky ground and the crypto vertical has been operating with ambiguity for far too long. Lack of regulatory clarity is problematic, but our politicians are disbelievers in this digital model and have an overt enforcement stance, while policies proposed so far in Washington are flawed and ill-conceived. This paper analyzes a policy framework that would position America’s success with crypto, while striking a balance between regulation, enforcement, consumer protection, transparency and innovation. Given the recent push to monitor cryptocurrency companies after the November 2022 collapse of FTX, defining a regulatory crypto framework will help accelerate American innovation and lead charge for the rest of the world. The urgency is for America’s need to balance freedom of financial innovation with the threat of fraud, and strike that balance of investor protection, investor innovation and investor freedom.

Digital money is coming and the future of banking, financing and trade is going to be digital - token based and block chain based. Undoubtedly, U.S. should lead in establishing the policy framework and a global institution for trade and governance for this digital money. These policies have to strike a balance between regulation, enforcement, consumer protection, transparency and innovation.

The internet today has evolved into a platform where commerce happens seamlessly across national borders. America now competes for geopolitical powers and global digital governance as nothing is a given – the world does not necessarily need to follow America’s path. A global digital currency push has naturally led to innovation globally in every corner of the globe. The Bitcoin protocol has allowed digital money to be exchanged safely on the internet leading to new forms of digital money, each with their own protocols.

Crypto’s legitimacy is in the fact that a free society wants to use it and Washington cannot be like an ostrich with the head in the sand. Unfortunately, America has fallen behind. Congress is filled with naysayers, behind time and way behind the technology, and they are now choosing to make political points over the ongoing crypto industry bloodbath of 2022. It is unfortunate that America’s congressional leaders still don’t cannot differentiate between a token, a Bitcoin or Stablecoin, and are far out from constructing a policy that will allowAmerica to demonstrate leadership in this space. Let alone leadership, America is in real danger of being left behind without a seat on the table.

Today, Crypto is seeing similar challenges that America grappled with during the free banking era (1837 to 1863) when banking fraud led to many economic crises - which ultimately led to comprehensive regulation and changes. Today’s digital economy is an altogether different ballgame; regulations that apply to banking cannot possibly be picked up and applied as is to the crypto world, but it needs to be constructed carefully and…

America needs a well-defined policy. Here are a few focus areas for such a policy:

We need regulators that will apply force of law to enforce good conduct without stifling innovation.

Here are a few regulations that are in the works:

"It’s fairly clear that we’ve been taking an enforcement-first approach in an area where we should be taking a regulatory-first approach. I think we’ve got the balance wrong right now.”

- Hester Peirce, Commissioner of the U.S. SEC and Crypto Mom

The regulation-by-enforcement approach of the U.S. SEC when it comes to crypto has been called into question by industry representatives, policymakers, and crypto consumers alike. The SEC continues to elevate its own quest for power over sound policy. Commissioner Peirce has called it out on multiple occasions publicly.

“I encourage my colleagues to understand Sam Bankman-Fried’s con for what it is — a failure of centralization, a failure of business ethics and a crime. It is not a failure of technology.” - Congressman Tom Emmer

“I'm very comfortable with making sure that people can include Bitcoin in their retirement funds because it's just different than other cryptocurrencies.” - Pro-crypto Senator Cynthia Lummis

“The digital dollar is bigger than any one issue and is about who owns the future. A digital dollar is far more than a federal benefits distribution mechanism, it is core digital architecture for our financial system.” - Chris Giancarlo, Chairman emeritus of the U.S. Commodity Futures Trading Commission, author of “Cryptodad: The fight for the future of money,” and founder of the Digital Dollar Project running the CFDC pilot

The policy construct should be based on a piecemeal customized approach:

We need a regulatory framework for CFDC: As per the White House fact sheet "Recognizing the potential benefits and risks of a U.S. Central Bank Digital Currency (CBDC), encourage the Federal Reserve to continue CBDC research, evaluation and call for the creation of a Treasury-led group to support the Fed. Reserve’s efforts.”

We should follow the recommendation from the Digital Dollar Project whose objective is to advance the exploration of a United States Central Bank Digital Currency (CBDC). that would evaluate the implementation and management of CBDC within the American economy. This pilot, called Project Lithium, explores how tokenized securities and a wholesale CBDC could operate within the U.S. settlement infrastructure leveraging distributed ledger technology (DLT). The pilot included Bank of America, Citi, Nomura, Northern Trust, State Street, Virtu Financial and Wells Fargo.

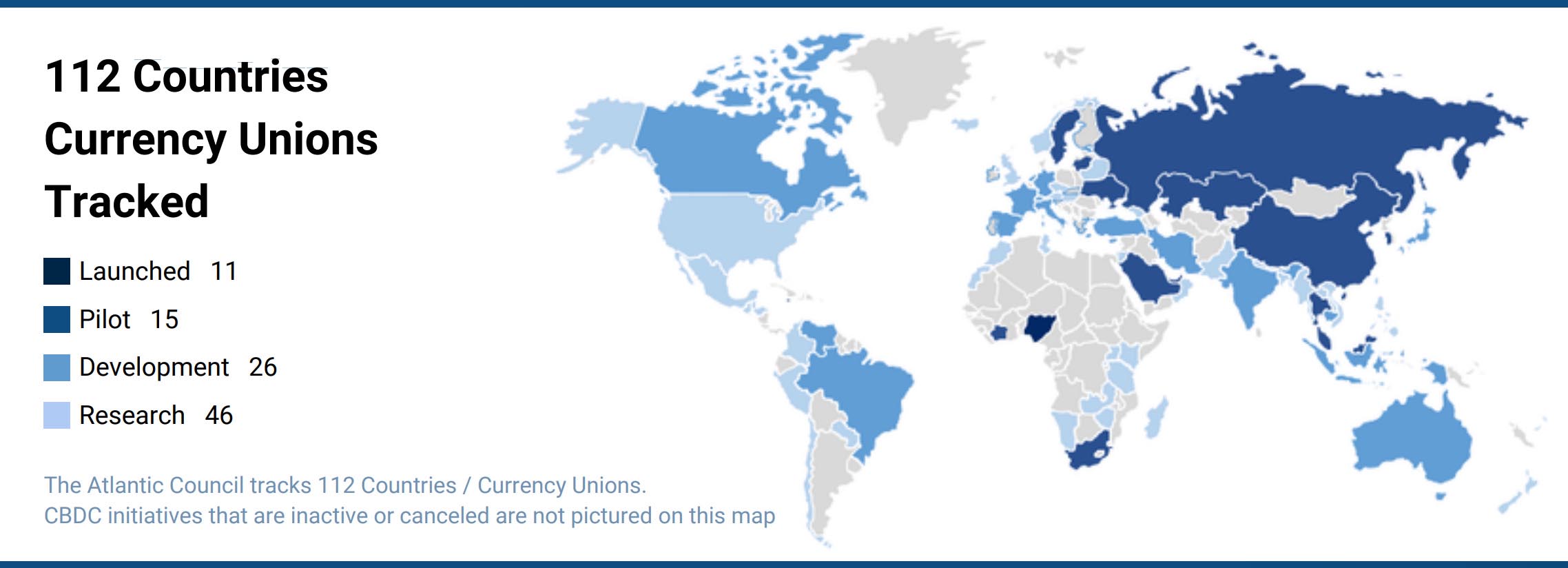

With CBDC, international transactional costs could shrink, and costs fall dramatically, by using distributed ledger technology. As per the Digital Dollar Project report - see image below - 112 countries of the world have already embarked upon a CBDC project. CBDCs are run by a permissioned blockchain network - a limited number of gatekeepers decides who can access, use and govern the blockchain.

China has pulled ahead with e-CNY, also known as the digital yuan - a digitized version of China's legal currency, the renminbi (RMB). It is issued by China's central bank, the People's Bank of China (PBOC) with the pitfalls of surveillance and censorship. This is the reason why there is a sense of urgency to maintain innovation leadership in America. We can not afford to let some other country like China get ahead in the game and threaten the dominance of the US dollar.

With CBDC, will USD’s share in global payments increase even more? Federal Reserve’s Governor Christopher Waller has claimed that this may not be necessary to protect the dollar’s privileged status. But what if e-CNY becomes the dominant currency in Asia and the Middle East and in other third world countries of the world? Each country would in theory have its own currency, but the foundation of the technology would be Chinese Yuan. Europe is working on the digital Euro that will go live in 2025.

More than 60 economies have come up with their own versions of smartphone-based, real-time, retail-payment systems. But the government does not want to be left out of the nation's money to be left entirely to the private sector, thus authorities have or will come up with a digital alternative for their legal tender. India has started testing of CBDC too, keeping it as anonymous as the currency note and all the relevant laws applicable to currency would be applicable to the digital currency, Thus, CBDC needs to be designed in such a way that prevents government surveillance of our personal finances and transactions we are involved with.

Stablecoins are cryptoassets with their value pegged to an external asset, such as a fiat currency. Stablecoins as a means of payments should be considered within the boundaries of the cryptoasset policy referenced above.

Since Stablecoin is a means of payment, it is not regulated by CFTC or SEC.

The President’s Working Group on Financial Markets (PWG), joined by the Federal Deposit Insurance Corporation (FDIC) and the Office of the Comptroller of the Currency (OCC), released a report on stablecoins that is a good starting point.

Senators Cynthia Lummis (R-WY) and Kirsten Gillibrand (D-NY) introduced the bipartisan bill, the Lummis-Gillibrand Responsible Financial Innovation Act that would empower various agencies with responsibility for regulating cryptoassets and also contains stablecoin provisions.

The Stablecoin TRUST Act (April 2022, Senator Pat Toomey (R-PA) ) would allow institutions to be licensed as a money transmitting business, a national limited payment stablecoin issuer, or an Insured Depository Institution (IDI). The Stablecoin TRUST Act would provide authority to license, supervise, examine and regulate national limited payment stablecoin issuers. The bill would require stablecoin issuers to maintain assets with a market value equal to at least 100% of the outstanding value of the stablecoins.”

The biggest disadvantage of Stablecoins is the possibility of surveillance and lack of privacy protection.

The SEC has not put together a formal plan to regulate crypto exchanges. America’s crypto exchanges should play with the same rules as non-crypto marketplaces and brokers. If FTX US exchange was regulated by the CFTC and SEC, might FTX US, perhaps their one million customers may have been protected. The inclusion of crypto exchanges under the money transmitter framework is flawed and needs to be corrected. The money transmitter approach is never going to be strict as a Federal securities watchdog.

Canada is a model to consider where crypto exchanges have to register with the Ontario Securities Commission, and are then provided insurance for failed broker-dealers.

The current exchange model in the U.S. has to protect retail customers from losing all their funds like Mt Gox, or FTX US.

Can the bitcoin protocol be the foundation for capital formation (issued by an enterprise or a corporate entity)? The answer is - yes! Which means SEC has a role with bitcoin for capital formation. Bitcoin does provide the foundation for privacy and protection unlike Stablecoin.

If bitcoin is set up as a commodity (like oil, iron ore, soybean, wheat, corn, minerals) means CFTC has a role in regulating it.

If bitcoin is used for smart contracts, it could be a role for state banking regulators.

It really depends on the function - not everything is a security that should be regulated by the SEC.

America’s failure to allow Bitcoin investments in the early days led to American investment going overseas. This can be avoided with a proactive Bitcoin approach.

SEC should allow an exchange traded product (ETP) to track the price of bitcoin and trade on American exchanges - which is currently permitted in many countries around the globe. The SEC's rejection cites concerns about market manipulation and the lack of a surveillance-sharing agreement between a “regulated market of significant size” and a regulated exchange. It seems that the SEC is applying more rigor to crypto assets and has denied spot bitcoin ETPs. SEC continues to deny bitcoin spot ETFs while approving several bitcoin future-based ETFs.

America definitely needs a better national Bitcoin strategy. Bitcoin has merits and should be treated separately - not clubbed with the rest of the crypto ecosystem. The sooner BTC finds acceptance in the mainstream, the sooner Washington will yield the way for BTC to thrive. If Bitcoin is to succeed, it must become an easy, fast medium of exchange than the options today. Which means the feds investing in innovation in this area, to build out an extensive network of nodes across the globe to facilitate these Bitcoin payments.

Bitcoin may have price volatility, but it is still a dream for many countries of the world where place your money could easily lose half its value in a year. Bitcoin has a future and America should not be caught with another sputnik moment.